Table of Contents

Understanding this financial term

When a client is thinking about selling a company, one of their favorite questions to ask is “How much is it worth?” After all, they’ve usually spent a considerable part of their lives building what (hopefully) amounts to a profitable enterprise. Sometimes it’s difficult for business owners to calculate the value of a business. The answer to the aforementioned question is “it depends” (and in our opinion, it’s a good idea to have it answered by a trained financial expert, lest I disclaim yet again that AttorneyX is not in the business of giving financial advice…).

However, you should be ready to have the conversation with an investment banker about the subject. You should know enough to be dangerous, so today we are going to introduce one of the most important metrics in evaluating a business: EBITDA.

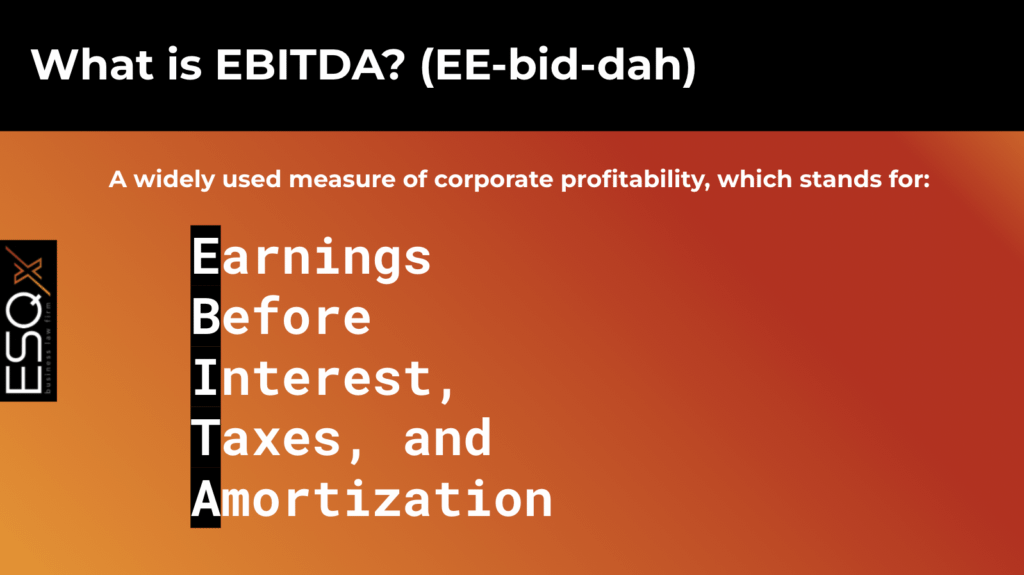

Like many words descended from acronyms, it isn’t pretty. Go ahead, say it out loud a few times: EE-bid-dah.

EBITDA stands for “Earnings before Interest, Taxes, Depreciation, and Amortization.” This metric is an alternative way of calculating profitability.

In doing so, we strip out the non-cash depreciation of a business, including amortization (like machinery, for example), and taxes (which can change over time). This metric attempts to represent profit from a purely cash standpoint, as it is generated by the company’s operations.

Keep in mind that EBITDA is not perfect. It is not recognized under generally-accepted accounting principles, so don’t expect you won’t need to know any other number about your business. There have been some claims that EBITDA overstates the profitability of a business as it has come to fame over the past decade or so. Let’s work through the details now as you conduct the due diligence process.

Key Terms of EBITDA

Earnings: Very simple. Your company’s net earnings or income.

Interest: Any and all interest paid by your company, typically on outstanding loans.

Taxes: Local, state, and federal income taxes. If you own an LLC, this number will be minimal, as LLCs pass through taxes to members.

Depreciation: How much depreciation a company is experiencing in a given year, as calculated on the company’s income statement. An accountant can produce this number.

Amortization: The gradual discounting of the value of a company’s intangible property. This is reported on a company’s income statement. For example, this can include intellectual property like patents or trademarks. The number represents the difference between the cost of past acquisitions and their fair market value when purchased.

Why Is EBITDA Used?

EBITDA can be used to measure cash flow for the company. It helps a prospective buyer get a better idea of what the company should be producing, in cash, in following years. Removing variable things like interest, depreciation, taxes and amortization produces a stable figure that a venture capitalist or buyer can use in his or her calculations. For example, if a company has a low net income due to high depreciation and amortization, it can still have a high EBITDA. In fact, EBITDA is widely used in such industries which are asset-intensive, such as manufacturing.

How to Calculate EBITDA

All you need to calculate EBITDA is a financial statement.

EBITDA = Net Income + Taxes + Interest Expense + Depreciation & Amortization

Example of EBITDA

Let’s say a Philadelphia-area company makes $40 million in annual revenue and incurs $10 million in cost of goods and $10 million in overhead. Depreciation and amortization expenses total $1 million each, yielding an operating profit of $18 million. The interest expense is $1 million, leaving us with earnings before taxes of $17 million. At a 20% tax rate, net income equals approximately $14 million.

To get EBITDA, you add back depreciation, amortization, interest, and taxes to net income:

Net Income $14,000,000

Depreciation +$1,000,000

Amortization +$1,000,000

Interest +$1,000,000

Taxes +$3,000,000

EBITDA = $20,000,000

History of EBITDA

In the 1970s and 1980s, investors involved in large buyouts found EBITDA a useful metric because it helped them estimate whether the prospective company had the profitability to service the debt it had previously taken on to operate. Investors can be squeamish about taking on too much debt in a buyout, especially if the debt is not being paid. Moreover, since an acquisition would probably cause a change in the structure of the organization, along with its tax liabilities, investors found it advantageous to exclude the figures of interest and tax from earnings. Those things are highly variable and subject to change. Lastly, depreciation and amortization are non-cash costs, and therefore do not affect a company’s ability to service debt. The most enticing target companies were ones with low amounts of near-term capital spending.

Although EBITDA was abused by some companies in the following years, like the tech bubble of the 1990s, it remains a reliable indicator for investors.

Problems with EBITDA

Remember earlier we told you that EBITDA is a “non-GAAP” measure? Because of this fact, the way it’s calculated can vary slightly. Some companies may emphasize it over net income because it usually makes them look better. In this way, it is sometimes used as a vanity metric. If a company suddenly starts reporting EBITDA, it may be because they are hiding something. That could be additional debt, or rising capital costs. Don’t let this distract you.

Additionally, EBITDA ignores the costs of assets and therefore does not represent cash earnings. This is a core criticism of the metric because it “assumes” profitability in future years. It does not account for market changes, interest rates, or a failure of sales and marketing to generate revenue. It is possible for a company to have high capital expenses that are not working on behalf of the company’s profitability. Moreover, financial mismanagement may be obfuscated more easily by relying solely on this metric, because it’s easier to hide things from investors.

What Matters Most

EBITDA is a very useful way that investors and business owners can communicate about the value of a company at a cocktail party without getting accountants involved. It lets you compare companies who may have different tax treatments and capital costs, and levels the playing field for their analysis. Always remember to consult an accountant for an in-depth review of a company’s assets before making a decision.